The Trump administration announced that as of August 29, it would end the tax exemption policy for low-value packages in all countries, marking the official implementation of the comprehensive tax policy.

https://www.whitehouse.gov/presidential-actions/2025/07/suspending-duty-free-de-minimis-treatment-for-all-countries/

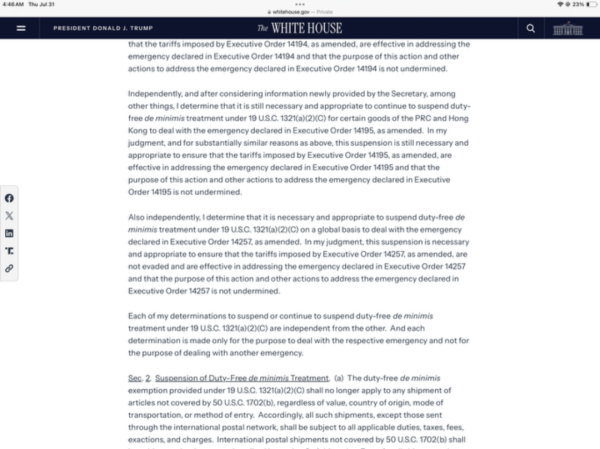

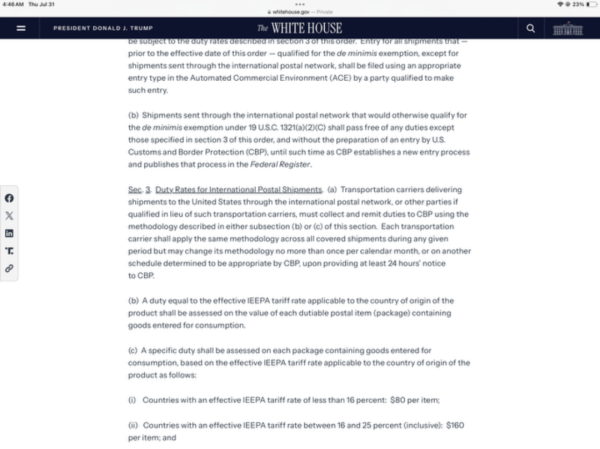

The original text is as above. This is also expected. President Trump announced the cancellation of the tax exemption policy for all low-value imported parcels in all countries and regions. No matter which country or region it is, whether through postal channels or commercial channels, all commercial transaction parcels will be subject to taxation. Starting from August 29th, that is to say, there is less than a month left. Of course, due to the particularity of international postal services, parcels through the postal channel can still be subject to AD valorem tax at the beginning. However, after the adaptation period, they will all be taxed at the general trade rate.

What is currently uncertain is how to supervise small-batch imported parcels, the inspection rate and customs clearance speed, as well as the inspection cost. In addition, for the postal channel, it is required that postal enterprises from over 200 countries and regions entrust carriers (airlines, shipping companies) to sign agreements with the US customs and purchase bonds. The initial workload for this will be extremely large. Can all aspects be coordinated well?

In conclusion, an era has come to a complete end. It was announced that the duty-free allowance for low-value duty-free parcels and the simplified supervision model for parcels in the United States have come to an end. From the perspective of cross-border e-commerce, the advantages of direct mail small parcels have vanished completely. The competitiveness of both postal channels and commercial parcels has basically disappeared. If one wants to carry out large-scale e-commerce of American imports, there is basically only the general trade method (traditional bulk trade, sea freight inventory), which is basically a disaster for small and medium-sized merchants.

Moreover, the implementation of this policy also marks a historical turning point for the international express delivery industry. The essential logic of the international express delivery industry, which has developed for 40 years, will change. The sharp decline in the stocks of UPS and Fedex in the capital market today is a direct response.

Latest! Trump: Imposing a 25% tariff! Take effect immediately!

"Big twist!" The US tariffs on China may be reduced by 20%! The paid customs duties may be refundable!

The volume of goods has declined, and the anticipated peak season demand has not materialized. In November, the volume of imported containers in the United States decreased by 5.4% month-on-month

A freight rate war is about to break out! The peak season of the container shipping market has come to an end, and freight rates on major routes have generally dropped

The "Measures for Announcing Tax Arrears" has been released! It will come into effect on March 1, 2026

Maersk Advises: General Average Declared for Vessel “Kyparissia”

Matson Launches Weekly Express Service: Laem Chabang (Thailand) - Shanghai - West America

Rates Rising! MSC, CMA CGM, Hapag-Lloyd, Maersk Hike December Prices on Key Routes