Last week, the export container shipping market remained generally stable, with freight rates on various routes continuing to show a divergent trend. Among them, rates on trans-Pacific routes to the U.S. fell significantly, while rates to Europe saw a 7.1% increase. Rates on the Mediterranean route remained flat.

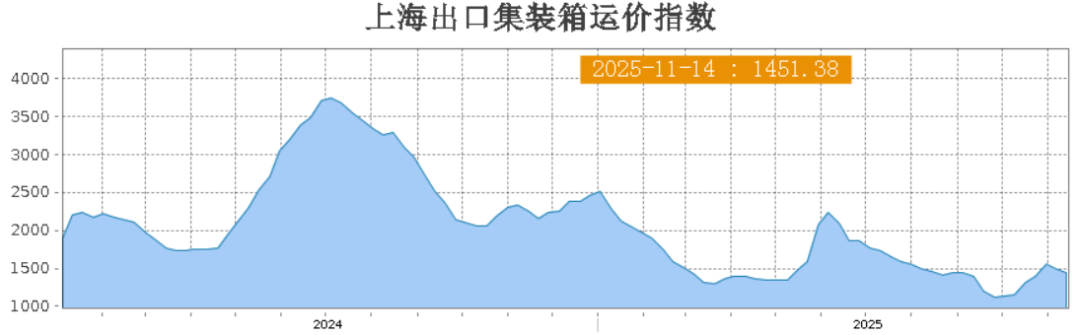

The latest Shanghai Export Container Composite Freight Index (SCFI) was released at 1451.38 points, a decrease of 2.9% from the previous period.

(Image source: Shanghai Shipping Exchange. Infringement will be removed.)

Europe Route:

Transport demand remained relatively stable, leading to an increase in market freight rates. On November 14, the market freight rate (ocean freight and surcharges) from Shanghai Port to the basic ports of Europe was $1,417/TEU, up 7.1% from the previous period.

Some analysts believe that recent vessel arrivals are coinciding with the Christmas holiday period, causing a slowdown in market shipments. Currently, the low-priced PA Alliance’s FP2 service has a blank sailing for week 47, and it is expected that routes in week 48 at the end of the month will be prone to overbooking. Furthermore, shipping lines may introduce a new round of rate increases in early December.

Mediterranean Route:

Supply and demand for cargo were balanced, and freight rates remained stable. On November 14, the market freight rate (ocean freight and surcharges) from Shanghai Port to the basic ports of the Mediterranean was $2,029/TEU, unchanged from the previous period.

Industry insiders stated that freight rates to the Eastern Mediterranean will be stable in late November, but capacity from various shipping lines is tight. For the PA Alliance’s MD1 service, which has a blank sailing in mid-December, the earliest available booking is for week 48 at the end of the month. The OA Alliance also has a blank sailing at the end of the month, while MSK’s in-house service has some immediate slots available. It is anticipated that Mediterranean freight rates may be pushed up in December.

North America Route:

Following the end of the longest government shutdown in U.S. history, transport demand lacks support, and spot market booking prices have fallen. On November 14, the market freight rates (ocean freight and surcharges) from Shanghai Port to the basic ports of the U.S. West and East Coasts were $1,823/FEU and$2,600/FEU, respectively, representing decreases of 17.6% and 8.7% from the previous period.

Currently, the North America route has entered the traditional lull period in November. Stockpiling for Black Friday and Christmas is largely complete, and the market is dominated by sporadic replenishment orders, leading to overall weak demand. The approaching slow season means that capacity will be relatively ample, and all shipping lines are actively seeking cargo.

Persian Gulf Route:

Market freight rates saw a slight increase. On November 14, the market freight rate (ocean freight and surcharges) from Shanghai Port to the basic ports of the Persian Gulf was $1,805/TEU, up 2.0% from the previous period.

Industry analysis suggests that while shipping companies wish to continue pushing up freight rates, the overall momentum is insufficient. Market demand for cargo is relatively stable, and it is expected that rate increases will be limited in the near term.

Australia/New Zealand Route:

Transport demand is stable and improving, and freight rates have continued their upward trend. On November 14, the market freight rate (ocean freight and surcharges) from Shanghai Port to the basic ports of Australia and New Zealand was $1,745/TEU, up 7.8% from the previous period.

Some industry insiders expect that some shipping lines will lead rate increases in late November. However, the consortium group including TSL/YML/SNL, as well as ZIM and MSK, have not implemented significant price hikes. It is advised that those with shipping plans arrange their bookings as soon as possible.

South America Route:

Growth in transport demand has been sluggish, and the decline in market freight rates has widened. On November 14, the market freight rate (ocean freight and surcharges) from Shanghai Port to the basic ports of South America was $1,691/TEU, a sharp drop of 22.1% from the previous period.

Currently, the overall supply and demand relationship in the market is loose. There is no pressure on capacity for any routes, and freight rates continue to trend downward.

Japan Route:

The transport market is basically stable, with market freight rates falling slightly. On November 14, the China Export to Japan Route Freight Index was 978.68 points.

A reminder to all shippers and freight forwarders: stay updated on freight rate trends for various routes. Before shipping, please check the latest schedules and rates, and plan your shipments in advance.

Source: Shanghai Shipping Exchange, sohang.com

Latest! Trump: Imposing a 25% tariff! Take effect immediately!

"Big twist!" The US tariffs on China may be reduced by 20%! The paid customs duties may be refundable!

The volume of goods has declined, and the anticipated peak season demand has not materialized. In November, the volume of imported containers in the United States decreased by 5.4% month-on-month

A freight rate war is about to break out! The peak season of the container shipping market has come to an end, and freight rates on major routes have generally dropped

The "Measures for Announcing Tax Arrears" has been released! It will come into effect on March 1, 2026

Maersk Advises: General Average Declared for Vessel “Kyparissia”

Matson Launches Weekly Express Service: Laem Chabang (Thailand) - Shanghai - West America

Rates Rising! MSC, CMA CGM, Hapag-Lloyd, Maersk Hike December Prices on Key Routes